At the start of 2022, 64% of Americans reported living paycheck to paycheck. And when unexpected expenses crop up, many turn to credit cards or predatory lenders for help, which often leads to a vicious cycle of debt. Lindsey Seal is determined to do something about this. Lindsey is vice president of partnerships at Immediate, a fintech startup based in Birmingham. The company partners with employers to provide their employees with on-demand access to earned wages whenever needed.

Along with personal finance, Lindsey is also passionate about seeing more women in leadership. Before taking her position at Immediate, she managed retail partnerships at Shipt. She was recently accepted to Chief, a private network for top female executives built to drive more women into leadership positions and keep them there. We’re excited to introduce our newest FACE of Birmingham, Lindsey Seal.

Can you explain a bit about how Immediate works?

We work with an employer to help give access to their employees for those earned wages. Many Americans are living paycheck to paycheck, and about 50 percent of Americans have less than $400 in a savings account. We go directly to employers and say, “Regardless of what you’re paying your employees or how often you’re paying them, wouldn’t it be great to give them a safety net, so they don’t have to lean on things like putting things on a credit card or — even worse — going to a predatory lender?”

And we want to do it in the most responsible way possible. We get a lot of pushback when talking to employers who say, “Isn’t this just going to make it worse? Does this put them further into debt?” Our product is built on the idea that this is a safety net, but we do want them to be responsible. So, we give limited access. We have some guardrails in place. Employees can get up to 50 percent of their earned wages but no more than $250 per transaction. And in a typical biweekly pay period, we limit the transactions to four per pay period.

April is financial literacy month. What are some of your top tips for women looking to improve their finances?

Understanding the money you make and the money you’re spending is where you have to start. When I was planning my wedding, I put together a spreadsheet. I was relentless on the budget. I sat down on a weekly basis to review that spreadsheet. I was very fortunate to have great parents who had saved for things like that and taught me that saving was important. Understanding what things cost and if it’s the most important or right thing for you to be spending that money on is key. We live in a materialistic world; we’re served so much content saying, “Buy this!” You have to be careful.

What can we do to manage our mindset so that we will stick to our budget?

That goes back to goal setting. Have something short-term and something longer-term. For example, my husband and I decided that we wanted to take a big trip. So, one of the things that we did was say, “We’re going to put X number of dollars away each day to save for this trip.” Having something big and fun on the horizon was great to work towards. I’ve been fortunate that I’ve had these opportunities.

Our users at Immediate aren’t that fortunate all the time. We get customer support tickets that say, “This is so great. I was able to pay my water bill this month,” or “I needed this because I really needed groceries.” It’s important to us as a company to step outside of ourselves and understand what we’re doing for people.

RELATED: How Crestline Pharmacy Marries ‘Mayberry’ and Modern Medicine

Tell us more about Chief and why it was important to you to join this network.

About two years ago, I saw a feature on the Today show about Chief. They had six or eight women sitting around talking about how they were in leadership positions, but it was hard to get there, and it was hard to maintain. It was hard to manage work, life, and everything that we do. At the beginning of the year, they opened up the network across the country. I immediately applied and did an interview; I was interested to hear feedback from other parts of the country. When I worked at Shipt, I realized that it was nice to have people with different experiences and different backgrounds. We can all learn from that.

What do you think needs to be done to get more women in leadership positions and keep them there?

To get them there, it’s definitely [about] having a great role model. When I started at Shipt, the woman who hired me was a very compelling person to me because she was very honest and open and always herself. As women, we have a different way of communicating and being. She just owned that. I had never seen anybody run with who they are in a work environment. It was so refreshing! So, finding a culture where I can be who I am has been the most important thing.

In terms of keeping women where they are, there’s got to be a lot of understanding. One of the coolest things I’ve seen at Immediate was when my boss, Matt Pierce (founder and CEO of the company), left the office one day and left his computer. He said, “I have a bunch of family stuff, and I didn’t want to be distracted.” He has always said he wants us to have a great work/life balance. It was refreshing that he wasn’t just saying these things to us — he actually does them.

What do you like to do when you’re not working?

I love group fitness. Most recently, I’ve really enjoyed going to Battle Republic in Homewood.

I love cooking. It’s a great stress reliever for me. I also love eating other people’s food. We’ve got such a great restaurant scene in Birmingham.

What are some of your favorite restaurants?

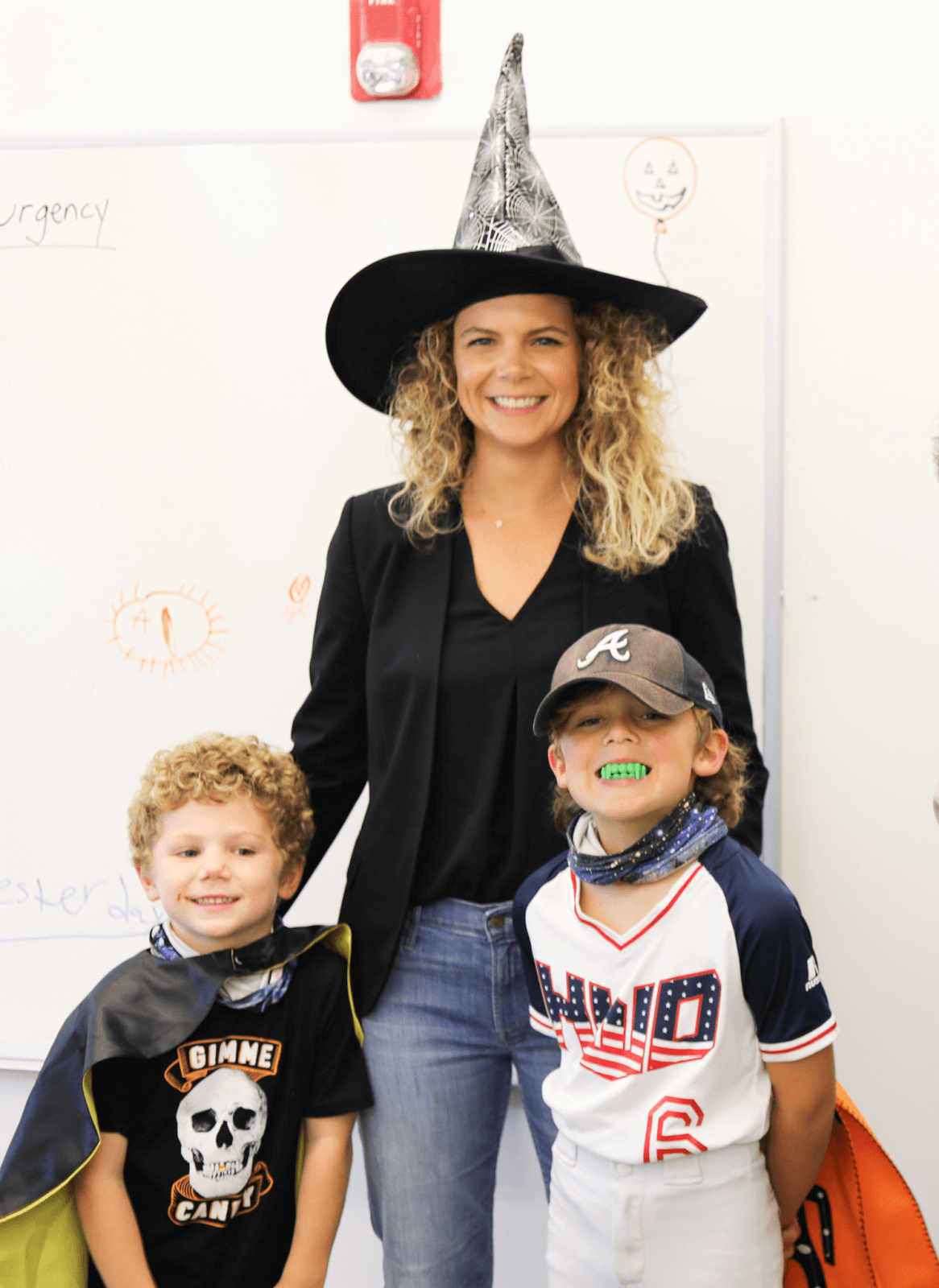

We live in Edgewood, and we always walk down to Local 39. They have the nicest people that work there, we always run into somebody, and they treat our kids very well when we break out the Etch-a-Sketch and coloring books. We have two boys, ages 6 and 8.

RELATED: Meet Dr. Sarah Boyce Sawyer, Founder of Dermatology & Laser of Alabama

What’s the best advice you have to offer?

My life motto is something Pat Summit said: “You can’t always control what happens to you, but you can control how you handle it.”

Name three things you can’t live without.

Family dinners, coffee, and curly hair products.

All photos courtesy of Lindsey Seal.

**********

Meet more inspiring Birmingham women in our FACES archives.